The guidance on this site is based on our own analysis and is meant to help you identify options and narrow down your choices. We do not advise or tell you which product to buy; undertake your own due diligence before entering into any agreement. Read our full disclosure here.

What is a Gap in Professional Indemnity Insurance?

Professional indemnity (PI) insurance typically works on a "claims-made" basis, which means that the policy will only pay out for valid claims made while the policy is active. To be protected by a policy sold on a 'claims-made' basis you need cover when the claim is made, and a retroactive date covering you from before the damage occurred.

Gaps in professional indemnity cover written on a claims-made basis should be avoided to ensure you're covered for claims that might come years after the fact. However, in many cases business owners find themselves with a gap. Professions required to hold PI insurance, like chartered accountants, can find themselves in breach of professional indemnity insurance regulations and guidance if there's a gap. We'll discuss how they can occur and how to help avoid a gap.

What is a gap in professional indemnity insurance?

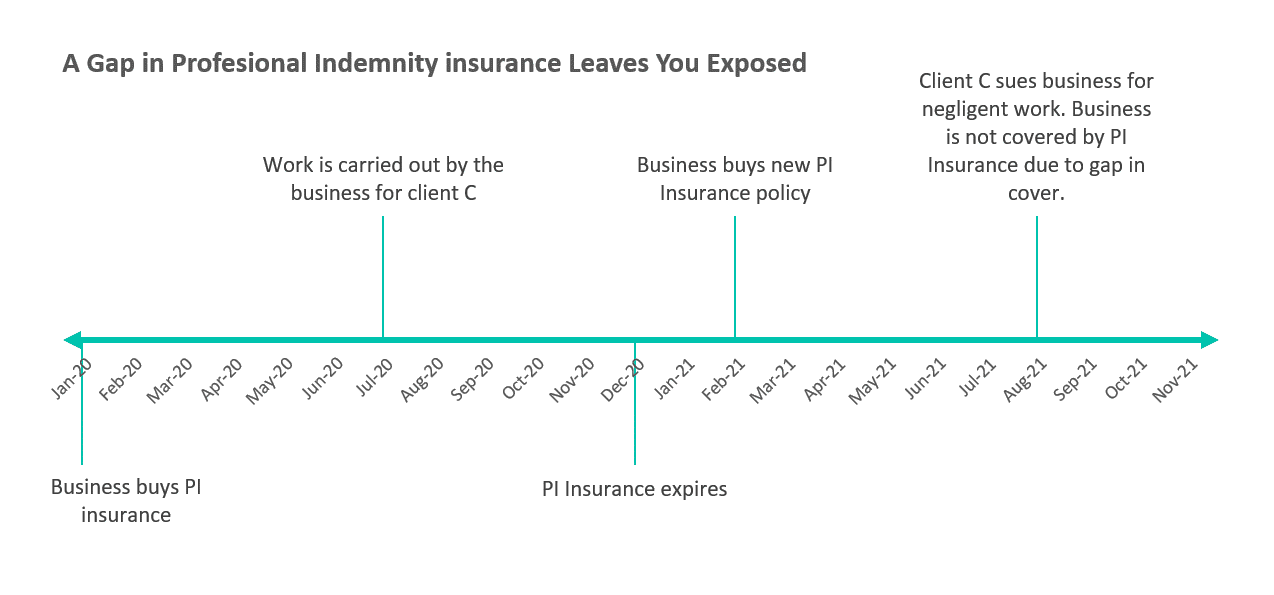

A gap in professional indemnity insurance is when there's a period of time (a gap) between two valid professional indemnity insurance policies. For instance, if your previous policy ended on 31 December 2020 and your new policy began 2 months later on 31 February 2021, there is a 2-month gap in cover.

When a gap occurs, this can leave a company vulnerable to exposure for claims to past work. This is because the current policy will only cover work looking back to the start date of that particular policy (in this case, 31 February):

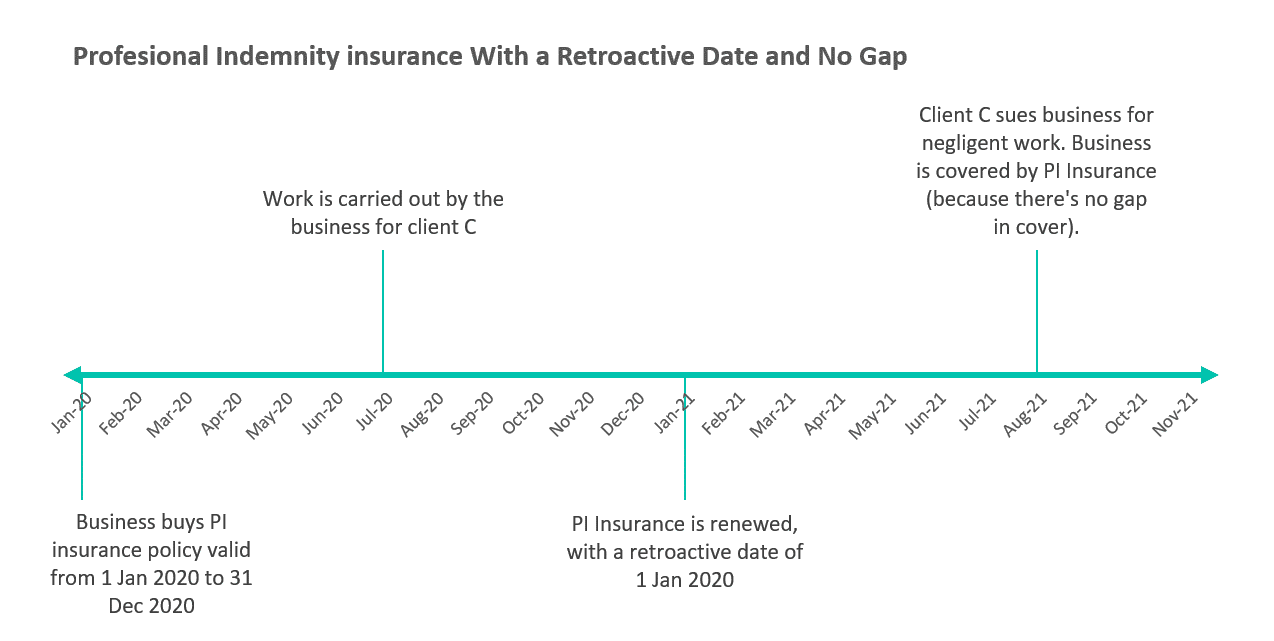

On the other hand, if there is no gap in cover (say, your first policy starts on 01 January 2020 and ends on 31 December 2020; the next policy begins on 01 January 2021) then your current policy would have a "retroactive date" that dates back to the earliest date of continuous cover (in this case, 01 January 2020). This means your current policy covers work looking back further than the start date of the policy—it covers work back to the retroactive date.

Your retroactive date is very simply a date added onto to your policy stating that 'claims originating from this date onwards are covered by the current policy'. This can occur when someone has continuous cover without a break (gap). A retroactive date can also be added to a policy for a professional who had no insurance in the first few years of their career.

This situation is more common in emerging professions like consulting, and the insurer might add a 5-20% premium (or more for riskier professions) for adding a retroactive date to cover uninsured years of work. Either way, you're then covered for work that took place from the retroactive date all the way through the end of your current policy.

Here's when a gap can occur

A gap in professional indemnity insurance means there is a period of time when there was no valid PI policy in place. A PII gap can occur after a policy expires and has not been renewed, for instance. Or between the cancellation of one policy and the start date of another policy. Even one day without cover creates a gap.

If your current insurer decides they no longer want to insure you at renewal, you might not have time to arrange for another policy to start immediately after the previous policy expires. In that case you could end up with a gap between policies. This can occur, for instance, to an accountant who is involved in tax schemes that their insurer no longer chooses to cover. Or an architect who has dealt with cladding in the past may find their current insurer no longer wishes to cover them.

Or if your current insurer hikes your rates significantly you may want to find an alternative provider, but as the underwriting process can be lengthy you may have time to buy a new policy that starts immediately after your previous policy expires.

- Your current insurer might hike your rates leaving you to look elsewhere, and you don't have time to line up an alternative in time

- Your current insurer might not offer you a renewal and you can't secure another policy in time

- Your policy expires without you realising it

- Remember: the underwriting process can be lengthy

Disadvantages of a gap

A gap can mean that historical work is not covered by insurance, as discussed above.

It can also mean that a professional loses an element of important cover that they've had for years under a 'legacy' policy.

For example, in some of the traditional professions where historic work is covered by clause but no contemporary policy would ever cover that work (e.g. cladding risks post Grenfell), a 'gap' in cover can be used as an excuse for insurers to eliminate that clause. As a result, a gap in cover for more complex or risky businesses can mean losing an aspect of cover that they have always had, a 'legacy' coverage.

How to avoid a gap in professional indemnity insurance

To help avoid having a gap in your PI insurance, always:

- Stay on top of your PI insurance renewal date. Be aware of your renewal date so it doesn't sneak up on you, or you don't miss it entirely.

- Initiate the renewal process early. This gives you time to find an alternative in case your existing insurer won't renew your policy or they increase your rates.

- Check market rates early. If you might be switching insurers, check the market early because the underwriting process can take time.

What to do if you have a gap in professional indemnity insurance

Where there have been gaps in cover, underwriters will nowadays often accept a signed 'No claims declaration' from their clients in exchange for adding coverage for the gap/maintaining a retroactive date.

This will take the form of:

'I, director of company X, state that I do not know of any circumstance or occurrence which has or is likely to result in a claim being made against my business, nor of any complaint or expression of dissatisfaction from my clients made against me or my business during the period of (end of last policy) to (start of new policy/ today's date)' - signed by a director

With one of these on record most underwriters will maintain cover happily. It's worth asking your insurer if you find yourself in this position.