The guidance on this site is based on our own analysis and is meant to help you identify options and narrow down your choices. We do not advise or tell you which product to buy; undertake your own due diligence before entering into any agreement. Read our full disclosure here.

What is run-off insurance, and who really needs it?

Run-off cover (also known as 'tail' or 'extended reporting' cover) is critical for those working in fields or running businesses where professional indemnity insurance or directors & officers insurance are key elements of risk management, such as architects, accountants, finance professionals, surveyors and other professional fields. Before you retire, change jobs, close your business or otherwise stop trading, make sure you're well protected with run-off insurance because liability claims can be brought years after the fact.

Tables of Contents

- What is 'run-off' insurance?

- Why is run-off insurance important?

- Who needs run-off insurance?

- How much does run-off insurance cost?

- How long do I need run-off cover?

'Run-off' insurance definition

'Run-off' or 'tail' cover typically refers to a type of professional liability insurance that a business or person uses after they stop trading—for instance in case of death or retirement.

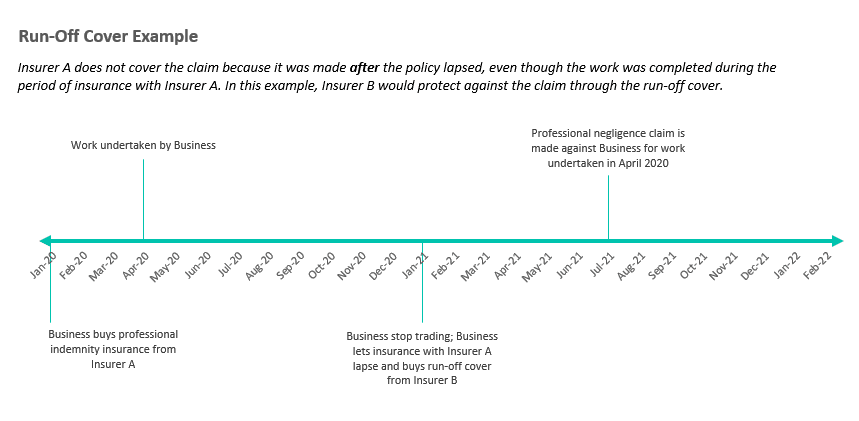

It protects against claims that are made during an extended reported period against work done earlier, while the business was still actively trading and fully insured. It does not cover new business written during the extended reporting period, and in fact there should be no further business carried out if a run-off policy is in place. If trading does continue, it should be under a new business name and a fresh insurance policy, in parallel to the run-off coverage.

Run-off cover can be purchased in the form of professional indemnity insurance or directors & officers insurance, or both.

Example:

- An architect retires and closes his business in January 2021, letting his professional indemnity insurance policy lapse. Six months later in July 2021 he is sued for work he completed in April 2020 on a large commercial project. Without tail insurance he would have no cover; with run-off professional indemnity insurance this claim would be covered.

Why is run-off insurance important?

Run-off insurance is necessary because professional liability insurance is typically written on a 'claims-made' basis. This means that you only have protection if you hold a valid insurance policy when the work was undertaken AND when a claim is made. So if you retire or your business stops trading and you let your professional liability insurance lapse without run-off insurance, you are at risk of liability claims.

Who needs run-off insurance?

If you were a director or officer of a company, or you or your business gave professional advice or service as part of your work, then you might want run-off insurance when you retire, change careers or otherwise stop trading. As claims can arise years after work was undertaken, a professional might need run-off insurance even after death. This is an issue to raise with the executor of a professional's estate unless they have been long retired.

How much does run-off insurance cost?

Run-off insurance should be cheaper than your professional liability insurance, because liability diminishes over time. It's more likely that an issue will arise closer to the time the work was undertaken than many years later—so the further away you get from the time the work was undertaken, the less likelihood of a claim, which means less risk for the underwriter and a lower insurance premium. And once you stop trading, you're no longer adding to the basket of work that could potentially result in a claim.

How much run-off cover do I need?

The amount of run-off cover you need depends very much on your unique situation. For reference, RICS made changes to the run-off requirements for their architect members, stipulating a minimum of £1,000,000 in run-off cover for six years. These changes were effective as of 1 April 2019.

Where can I get a run-off cover policy?

You are best approaching your existing insurer for a run-off quote, as insurers don’t like to quote run-off without having held a business’ insurance policy for at least a year beforehand. This is due to the industry belief that run-off coverage is a courtesy to clients, giving them peace of mind in their retirement.

In many cases where a business activity is unlikely to result in a claim until months or even years later (i.e. construction design and calculation), the risk an insurer is taking when providing run-off is about the same as for a practicing business until a year or two have passed. For this reason it’s worth checking what the run-off terms and conditions are with your existing insurer at renewal, even if you don’t plan on retiring for some time. If the terms aren’t favourable, consider switching insurer a year or two before retirement.

How long do I need run-off cover?

According to Nelsons Solicitors, professional negligence claims can be made up to six years after the alleged damage occurred, but under certain circumstances a professional could be liable for 15 years or more.

With that in mind, those with professional liability exposure might want to carry run-off insurance for 6 years after they stop working, but you can discuss your needs with a specialist broker or directly with your insurance company.