The guidance on this site is based on our own analysis and is meant to help you identify options and narrow down your choices. We do not advise or tell you which product to buy; undertake your own due diligence before entering into any agreement. Read our full disclosure here.

Does turning 70 affect my car insurance?

Cheap Car Insurance for Over 70s

Quickly compare over 100 UK insurance providers. Powered by QuoteZone.

Most of us know that young or inexperienced drivers pay significantly more for car insurance, but what about drivers at the other end of the spectrum? Well, despite years of driving experience, turning 70 can also affect the cost of your car insurance. We take a look at what that impact is and what you can do about it.

How does turning 70 affect driving?

When you reach 70 years of age, you’ll need to renew your driving licence at GOV.UK. You’ll then need to renew your licence every three years instead of ten. The good news is that you don’t have to wait until your birthday to renew, and you can start the process if you’re going to be 70 in the next 90 days.

So long as you’re in good health and meet the standard eyesight requirements, you’ll receive your renewed licence in the post as normal. You can also still drive while your licence is being renewed, as long as your previous licence was still valid, and you haven’t been disqualified from driving. (But if you have any health issues, learn more about which medical conditions you need to declare for car insurance.)

Will my car insurance increase when I turn 70?

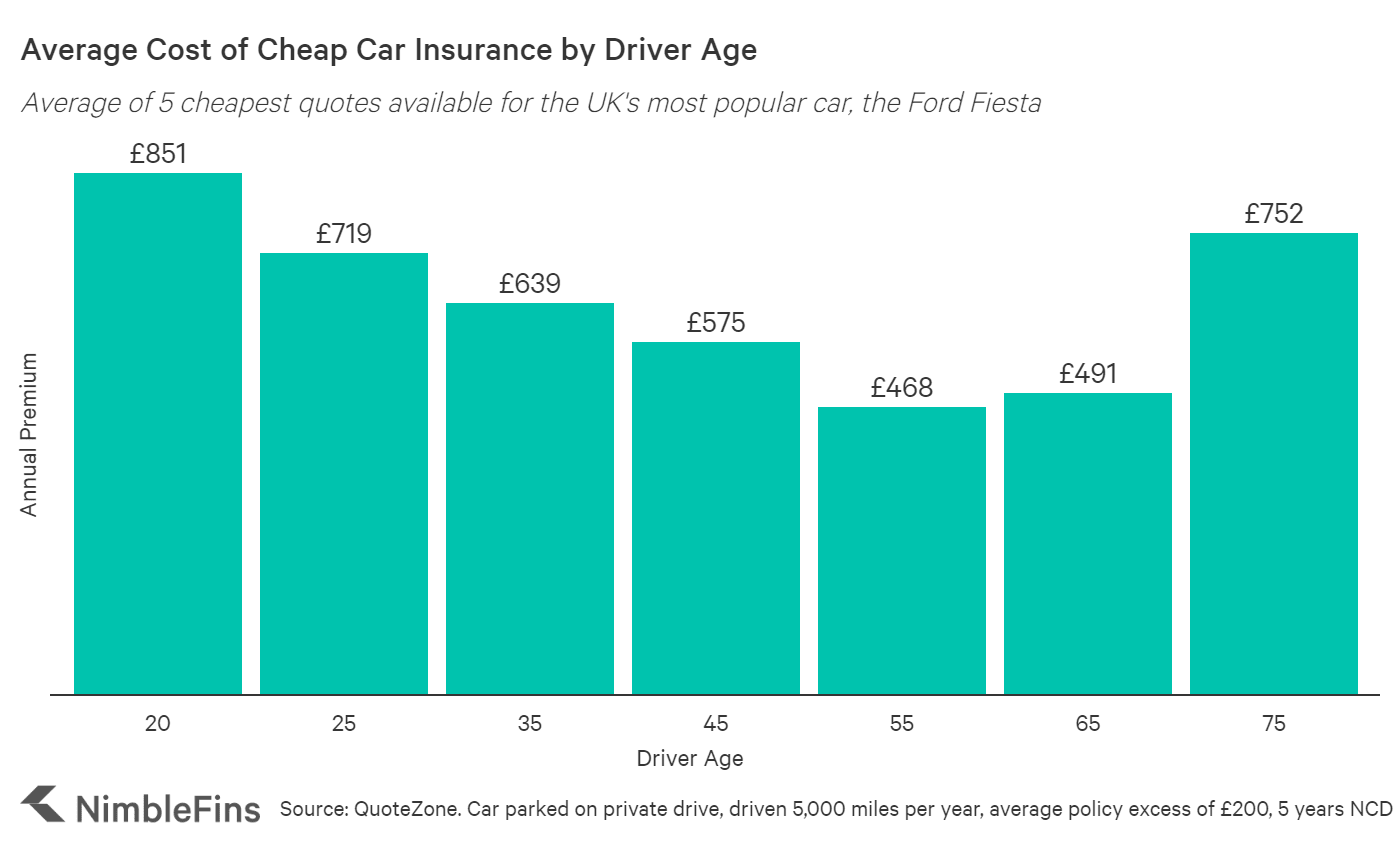

Generally speaking, yes. When you turn 70, you can expect to pay slightly more for car insurance compared to when you were in your 50s or 60s. The NimbleFins car insurance experts studied thousands of car insurance quotes to learn about the cost of car insurance by age and found the cost of a cheaper comprehensive policy for someone aged 75 was £752, which was £261 more expensive than a policy for a 65-year-old.

This is because drivers aged 70 and over are considered to be at greater risk of having an accident. Data from the Association of British Insurers (ABI) supports this and shows that drivers aged 71 and over make more frequent claims compared to those in their 60s.

Do I need to declare any medical conditions when I reach 70?

You don’t need to declare all medical conditions, just those that could affect your ability to drive; these are known as ‘notifiable medical conditions.’ This includes certain heart conditions such as, epilepsy, glaucoma, and diabetes.

If you have a notifiable medical condition (a full list is available at GOV.UK) you must make sure you declare it to the DVLA (Driver and Vehicle Licensing Agency). If you don’t, you could be fined up to £1,000 and be taken to court if you have an accident.

Do I need specialist over 70s car insurance?

No, you’re not obliged to take out a specific over 70s insurance policy, but there are insurers that do specialise in 70+ car cover.

Fundamentally, any policy you choose (either from a mainstream or specialist insurer) will cover the same incidents and risks according to the level of cover you opt for:

- Third party only – this compensates other people for damage you cause

- Third party, fire and theft – as well as third party only, these policies will also compensate you if your car is damaged by fire or is stolen.

- Comprehensive – this includes third party, fire and theft and will also pay to repair or replace your car if it’s damaged or written off. It’s the highest level of cover you can buy in the UK.

Does specialist over 70s car insurance come with added benefits?

Policies that are designed for the over 70s sometimes come with additional features that you would normally need to pay extra for. What those are will depend on the insurer, but policies could include:

- Protected No Claims Discount.

- Guaranteed courtesy car.

- Onward taxi to your destination if you break down mid-journey.

- Fixed premiums for a certain number of years (as long as your details don’t change).

With this in mind, it’s well worth comparing specialist and mainstream insurers just to see what’s on offer and at what price.

Is there an age limit on car insurance?

Some mainstream insurers do have age limits on their car insurance policies. In these examples, policies tend to be capped at age 84 so if you’re 85 and over, a few insurers might not be able to offer you a new policy.

On the other hand, specialist over 70s insurers don’t usually have age restrictions and as long as you’re fit to drive, you’ll be able to find a suitable policy.

Should I tell my insurer if I’ve retired?

It’s a good idea to let your insurer know when you retire as it could shave a little off your premium. This is because you’ll no longer be commuting to work and in turn, it could mean you drive fewer miles. This lowers the chances of you being involved in an accident and could help you keep costs as low as possible.

What can I do to lower over 70s car insurance?

It doesn’t matter how old you are, there are always ways to keep car insurance costs down – here are just a few ideas:

- Pay for your policy in one go – paying in instalments means you’re likely to pay added interest fees.

- Increase your voluntary excess – but make sure it’s still affordable as you’ll need to pay it for a claim to proceed.

- Be accurate about your mileage – rounding up the number of miles you cover annually could push you into the next price bracket so try and be as accurate as you can.

- Increase your car’s security – parking in a locked garage or on a private driveway will have the biggest impact on your premium. If neither of these is possible, you could invest in a security device instead.

- Choose a telematics policy – telematics (or Black Box insurance) is usually associated with young drivers, but older drivers can benefit from these policies too. A telematics device fitted to your car will monitor speed, braking, and acceleration with premiums adjusted according to how well you drive.

However, the best way to find car insurance to fit your budget if you’re 70 or older, is to compare a range of policies from different insurers. To do that, simply answer a few questions and together with our friends at Quotezone, we’ll do the searching for you.

Find car insurance today.

Powered by QuoteZone.

Get Quotes

- Rated 4.8 out of 5 stars on Reviews.co.uk

- 300,000+ quotes completed per month

- Fill out only one form