Sign up to the NimbleFins Newsletter

Get our email to receive tips on household budgeting and savings, personal finance deals like best credit card and bank account offers, insurance reminders, top tips for buying personal finance products, access to our latest research and studies, and more.

It's very easy to unsubscribe—simply visit our unsubscribe page and enter your email address.

At the moment we send our main newsletter fortnightly (every two weeks). We may also send other emails on occasion, for instance if there is important news to share or to highlight a particular theme (e.g. energy savings).

No, it's completely free to receive the NimbleFins Newsletter.

NimbleFins Newsletter 30 April 2024

Click to go directly to our newsletter from 30 April 2024.

NimbleFins Newsletter 16 April 2024

Click to go directly to our newsletter from 16 April 2024.

NimbleFins Newsletter 02 April 2024

Click to go directly to our newsletter from 02 April 2024.

NimbleFins Newsletter 19 March 2024

Click to go directly to our newsletter from 19 March 2024.

NimbleFins Newsletter 5 March 2024

Click to go directly to our newsletter from 5 March 2024.

NimbleFins Newsletter 20 February 2024

Click to go directly to our newsletter from 20 February 2024.

NimbleFins Newsletter 06 February 2024

Click to go directly to our newsletter from 06 February 2024.

NimbleFins Newsletter 23 January 2024

Click to go directly to our newsletter from 23 January 2024.

NimbleFins Newsletter 09 January 2024

Click to go directly to our newsletter from 09 January 2024.

NimbleFins Newsletter 12 December 2023

Click to go directly to our newsletter from 12 December 2023.

NimbleFins Newsletter 28 November 2023

Click to go directly to our newsletter from 28 November 2023.

NimbleFins Newsletter 14 November 2023

Click to go directly to our newsletter from 14 November 2023.

NimbleFins Newsletter 31 October 2023

Click to go directly to our newsletter from 31 October 2023.

NimbleFins Newsletter 17 October 2023

Click to go directly to our newsletter from 17 October 2023.

NimbleFins Newsletter 3 October 2023

Click to go directly to our newsletter from 3 October 2023.

NimbleFins Newsletter 19 September 2023

Click to go directly to our newsletter from 19 September 2023.

NimbleFins Newsletter 05 September 2023

Click to go directly to our newsletter from 05 September 2023.

NimbleFins Newsletter 22 August 2023

Click to go directly to our newsletter from 22 August 2023.

NimbleFins Newsletter 08 August 2023

Click to go directly to our newsletter from 08 August 2023.

NimbleFins Newsletter 25 July 2023

Click to go directly to our newsletter from 25 July 2023.

NimbleFins Newsletter 11 July 2023

Click to go directly to our newsletter from 11 July 2023.

NimbleFins Newsletter 27 June 2023

Click to go directly to our newsletter from 27 June 2023.

NimbleFins Newsletter 13 June 2023

Click to go directly to our newsletter from 13 June 2023.

NimbleFins Newsletter 30 May 2023

Click to go directly to our newsletter from 30 May 2023.

NimbleFins Newsletter 16 May 2023

Click to go directly to our newsletter from 16 May 2023.

NimbleFins Newsletter 02 May 2023

Click to go directly to our newsletter from 02 May 2023.

NimbleFins Newsletter 18 April 2023

Click to go directly to our newsletter from 18 April 2023.

NimbleFins Newsletter 04 April 2023

Click to go directly to our newsletter from 04 April 2023.

NimbleFins Newsletter 21 March 2023

Click to go directly to our newsletter from 21 March 2023.

NimbleFins Newsletter 07 March 2023

Click to go directly to our newsletter from 07 March 2023.

NimbleFins Newsletter 21 February 2023

Click to go directly to our newsletter from 21 February 2023.

NimbleFins Newsletter 07 February 2023

Click to go directly to our newsletter from 07 February 2023.

NimbleFins Newsletter 24 January 2023

Click to go directly to our newsletter from 24 January 2023.

NimbleFins Newsletter 10 January 2023

Click to go directly to our newsletter from 10 January 2023.

NimbleFins Newsletter 27 December 2022

Click to go directly to our newsletter from 27 December 2022.

NimbleFins Newsletter 13 December 2022

Click to go directly to our newsletter from 13 December 2022.

NimbleFins Newsletter 29 November 2022

Click to go directly to our newsletter from 29 November 2022.

NimbleFins Newsletter 15 November 2022

This week in the NimbleFins newsletter...

UK savings crisis, upcoming tax hikes, & rental market fears

A recent survey has suggested that a quarter of UK adults have less than £100 in the bank for emergencies. It's a worrying statistic to say the least, especially as the cost of living crisis is set to get even worse over the coming months.

We already know inflation is predicted to go even higher next year, meaning interest rates will almost certainly continue heading upwards. Meanwhile, the Bank of England recently revealed the UK is heading for its longest-ever recession.

In addition to all of that, Thursday's Autumn Statement is expected to include a host of cross-cutting tax hikes. "Taxes are going to go up," the Chancellor told the BBC this week.

Energy bill worries remain very much in the air, too. We shouldn't forget that the current support on offer will be massively scaled back within months, with speculation that only the most vulnerable will be helped.

Sadly, scammers are already trying to exploit the current cost of living crisis. This week we've taken a look at how some firms are using fake claims to sell high-risk financial products, while others have been keen to exploit the Government's £650 cost of living payments.

On the subject of personal finance pressures, it's an unfortunate fact that debt collection agencies are likely to be busier than usual over the next few months - especially after the festive season. If you've been contacted by one of these firms don't panic. Instead, take the time to read our article that explains how you can deal with debt collection agencies - it could save you time, money, and a lot of worry!

In other news, buy-to-let landlords are already hurting from rising interest rates. Some lobby groups have suggested it could make the rental market even worse given the fact that 40% of landlords have a mortgage on their properties. This article we've put together has all of the details.

Also this week... have you ever considered owning an electric vehicle? A new report suggests 70% of drivers are put off from owning a EV due to soaring energy costs. On top of this, our exclusive research has found the average cost of car insurance for EV's is 13% higher than petrol and diesel vehicles*.

As always, we've a bundle of money-saving deals this week, including a way to earn a FREE tenner to spend at Boots*, 20% off 'Tu' clothing at Sainsburys, plus a side hustle idea* which could potentially help you through the cost of living crisis.

Enjoying our newsletter? Forward this email to friends & family so they can keep on top of our latest money news, deals and tips. Also, if you have Twitter, why not follow us?

Fun Deals.

- Discount travel insurance. Get 10% off at CoverForYou* (use code: CFY10 at checkout) or 5% off at Cedar Tree* (code: CT5TREE).

- 'Tu' good to be true. Get 20% off Tu (Men & Women's) clothing at Sainsbury's. Ends Sun.

- Seeking a side hustle? Earn up to £400 per month by taking online surveys* (pays an avg £3 per survey).

- Coffee connoisseur? Get 10% off a GUSTATORY coffee subscription* for 3mths. Use code: 10FOR3 at checkout.

- Bag a FREE tenner at Boots. Spend £10 get £10 back at Boots* via Topcashback. New TCB members only (see site for full Ts&Cs).

- Can your dog save the planet? Grab 50% off 'eco' dog food* at Bug Bakes.

- World cup fever. Score £15 off a £15 spend at Kitbag* through Topcashback. New TCB members only (see site for full Ts&Cs).

- Tesco £5 'trick'. Some Tesco £50 gift cards now incl a £5 'bonus' to be spent over Dec. Can you find one in-store?

- O2 customer? Get 3mths FREE Apple TV & Apple Fitness+. New & existing custs. O2 Priority app required.

Important Money News (what is happening NOW).

- Majority of drivers put off electric vehicles due to energy price increases, poll suggests.

- Scam warning as £650 cost of living payments rolled out.

- Households being switched from smart meters to more expensive prepayment meters without warning.

- Savings rates continue to rise as Aldermore launches new 2.75% 'easy-access' savings account.

Money Tips.

- Have you been contacted by a debt collection agency? Here's how you can deal with these firms.

- Cash-strapped Britons are being warned of scams and risky financial deals as authorities intervened in a record number of adverts for misleading products.

- DIY homeowners have been warned not to attempt a number of repairs or upgrades themselves or risk breaking the law.

- What happens to your credit score when you apply for a credit card?

Best Financial Products.

- Got savings? Earn up to 2.75% easy-access, or up to 5% in a fixed account. Our updated best savings account guide has all of the latest rates.

- HSBC joins the bank switch party with a new £200 offer. Our best bank accounts guide has all of the details.

- Are you in credit card debt? Shift it to 0% with a balance transfer credit card. Right now you can shift debt for up to 34 mths interest-free.

Small Business.

Buy-to-let market could be seriously harmed by rising interest rates causing a sell off.

Data Trends.

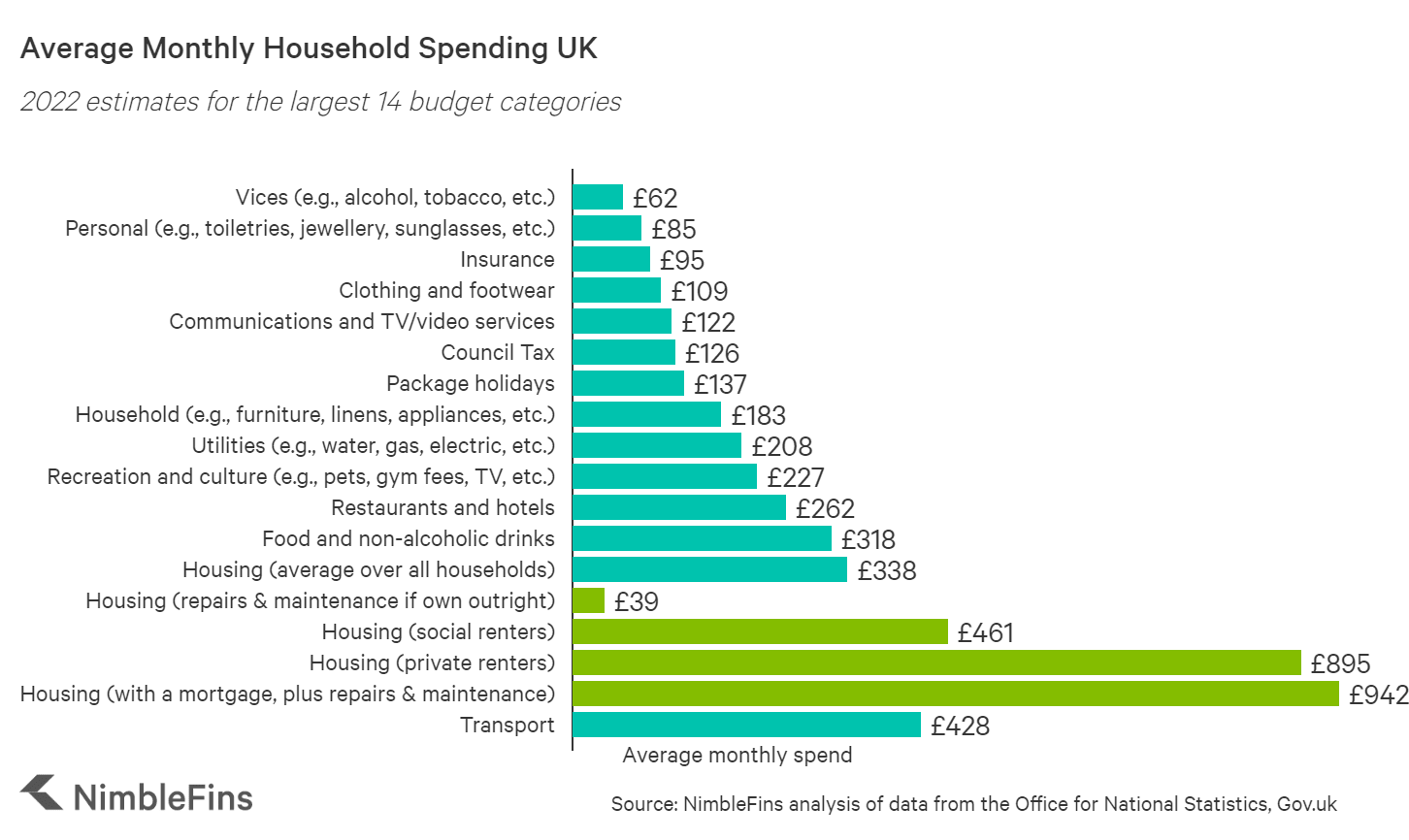

- We've updated our estimates for average household spending to take into account the latest inflation figures. Here's how the typical household spends around £671 per week to live.

NimbleFins Newsletter 01 November 2022

This week in the NimbleFins newsletter...

Interest rates, the end of cheap borrowing, & boosting your state pension

All eyes will be on the Bank of England this Thursday as its Monetary Policy Committee will decide on whether to hike interest rates once again. The Bank will meet just days after the US Federal Reserve votes on raising interest rates across the pond.

Interestingly, markets are expecting a hefty 75 basis points rise in both the UK and US this week, though the Bank of England has a history of shying away from bigger rises if it can get away with it.

Even if the UK's central Bank doesn't announce a big hike, it's a near certainty that borrowing costs will continue to rise for the foreseeable future. So what does this all mean? Well, if you're looking to borrow it's likely you'll be interested in an article we've put together on how rising rates is likely to influence the 0% credit card and personal loans market.

Given interest rates are rising, so too are savings rates. This week, we've taken a look at how it's possible to earn 5.15% AER interest via a current account. On the subject of savings, we've also explored reasons why Cash ISAs are likely to become more popular.

Also this week.. are you aged 45-70? If so, we explain how it may possible to boost your state pension by THOUSANDS. Plus, we explore whether it's worth worrying about energy blackouts this winter. As usual, we've a list of some hot money-saving deals too, including 50% off a Pret subscription, and how you can bag a free £10 for signing up to a leading cashback website.

Enjoying our newsletter? Forward this email to friends & family so they can keep on top of our latest money news, deals and tips. Also, if you have Twitter, why not follow us?

Fun Deals.

- Amex cardholder? Check 'My offers' in your app to see if you're eligible for £5 statement credit on a £25+ spend.

- TopCashback newbie? Grab £10 off when you spend £10+* at participating retailers.

- Put Amazon Music on trial. Try Amazon Music Unlimited FREE for 30 days. News custs only. Cancel before trial ends or it's £8.99/mth.

- Can't wait for Xmas? Get a 'Free' Cadbury Heroes advert calendar* at Cadbury Gifts (just pay £3.99 P&P). New TopCashback members only.

- Hungry for a freebie? Ask for a 'Henry' at Morrisons Cafe for a free jacket potato and beans meal. Ends 6 Nov.

- Fix that squeaky wheel. Grab £5 off a £20+ spend at Halfords by signing up for its free 'Motoring Club'. Not valid on gift cards.

- Do a runner at the Eden Project. Join its Saturday morning 5K Parkrun & gain free entry to the site (normally £32.50).

- Weeknight takeaway? Get £5 cashback on a £10+ spend at Just Eat*, via TopCashback.

- Get 50% off a Pret coffee subscription. Grab up to 5 drinks per day. £25/mth if you don't cancel during 1st mth. New custs only.

Important Money News (what is happening NOW).

- Aged 45 to 70? You could turn £800 Into £5,550 by topping up your state pension.

- Mini-budget plans reversed - what it means for you and your money.

- Should you open an ISA? With savings rates rising, tax-efficient cash ISAs are now back in the spotlight

Money Tips.

- It's now possible to earn up to 5.12% savings interest in a current account. Here's how to boost the interest rate on your cash.

- Brits could be hit with blackouts this winter - how to prepare.

- Thousands of families missing out on £442 help towards food bills - are you eligible?

- Cheap Personal Loans vs 0% credit cards. Which wins for cheap borrowing?

Best Financial Products.

- Looking for a place to stash your cash? Bag up to 2.5% AER easy-access, or up to 4.9% AER fixed. Our updated savings guide has all of the details.

- Fancy a free £200? FOUR banks are offering now offering bank switch bonusess in a bid to attract new customers. Our best bank account guides has everything you need to know.

- Do you have credit card debt? Take a look at our balance transfer credit cards guide to discover how you can cut your interest rate to zero.

Small Business.

NimbleFIns has updated our ranking of the best public liability companies for small businesses. See how customer rankings and features compare here.

Data Trends.

- If house prices fall, would you consider buying a holiday home to rent out? NimbleFins ran the data to find out which areas are most popular for tourism and have the best rental yields.

NimbleFins Newsletter 04 October 2022

This week in the NimbleFins newsletter...

Mini-budget shenanigans, energy price cap confusion, & soaring mortgage rates

From lifting the cap on bankers' bonuses, reversing the National Insurance hike, to unprecedented tax cuts, Kwasi Kwarteng’s recent mini budget certainly didn’t pull any punches. Sadly, the markets didn’t respond well, with the pound plummeting against the US dollar from the moment the Chancellor opened his mouth.

While the new political leadership has indicated it'll press ahead with its change of economic direction, tax cuts for higher-rate taxpayers was seemingly a step too far. On Monday it was announced the decision to scrap the 45% tax band will no longer go ahead. But will further u-turn’s follow? Homeowners may hope so, given that mortgage rates have already soared. For first-time buyers, however, a house price crash may be welcomed.

In other news, the PM was criticised last week after wrongly claiming energy bills were capped at £2,500 per year. This is not the case, as the more energy you use, the more you pay. Confused? This week we’ve taken a closer look at how the energy price cap works and explain why Liz Truss got it wrong.

On the subject of rising costs, it was recently announced that UK inflation is actually falling. But did you know that some experts are predicting prices will continue rising for TWO YEARS?

Also... are you a driver? If so, we’ve the lowdown on 10 car insurance myths. Plus, we’ve also taken a look at whether advanced driver training courses can save you a packet on your policy. Meanwhile, for those of you with home insurance, you may be interested to learn whether having a poor credit score could impact the cost of insuring your contents.

As always, we’ve the latest personal finance products this week, including a host of new, generous savings account deals thanks to rising interest rates. We’ve a host money-saving deals too, including a tonne of supermarket discounts. So, whether you shop at Iceland, Sainsbury’s, or Tesco, read on to discover how to cut your bill at the till.

Enjoying our newsletter? Forward this email to friends & family so they can keep on top of our latest money news, deals and tips. Also, if you have Twitter, why not follow us?

(P.s congratulations to Kat and Jaz, the two random winners of our £50 giveaways. Katy has told us she's planning to use her voucher to buy an electric blanket for some targeted heating this winter).

Fun Deals.

- Ice-cool saving. Grab £10 off a £35+ shop* at Iceland via Topcashback

- Sainsbury's shopper? Get £10 cashback* on a £40+ grocery shop via Topcashback

- Every little helps. Get £8 off Tesco click & collect* via Topcashback. New custs only.

- Vodafone customer? Get £5 off Morrison's fuel through Vodafone's 'VeryMe' rewards.

- Take a hike. Get 10% off at Berghaus.com. Must sign up to its newsletter on its website.

- Whatever next! Bag up to 50% off at Next (online & in store) through its 'mid-season' sale.

- Peckish? Grab a FREE sausage roll or bake & hot drink. Must download the Greggs mobile app.

- In the market for furniture? Get £15 off a £150+ spend at Wayfair. Just sign up to its newsletter.

- Free night out? Sign up to Applause Store & bag free tix for TV show recordings.

Important Money News (what is happening NOW).

- The energy price cap is NOT £2,500 for every household, just households with 'typical' energy usage. Read about the real per kWh unit cap here.

- Inflation eases to 9.9%: What’s rising and falling as experts predict soaring prices to last for two years

- Van insurance skyrockets in first half of 2022 - here’s how much you could pay

- Is the AJ Bell Youinvest platform any good? We take a look at the pros and cons.

- Mortgage rates soar with average two-year fixed rate edging close to 6%. Read the latest news and opinions.

Money Tips.

- Looking to be rewarded for your normal, everyday spending? Take a look at our cashback credit cards guide for how these cards work, plus a list of the top deals out there right now.

- Fact checking car insurance myths. Which of these 10 common car insurance myths do you (mistakenly) believe?

- Advanced driving courses are often advertised as a way to save money on your car insurance, but is that true? We explore whether or not advanced driver training is worth the extra cost.

- Does a poor credit score affect home insurance? Find out here.

Best Financial Products.

- Savings rates continue to rise. Right now you can get up to 2.5% AER easy-access, or up to 4.6% AER fixed. Our best savings guide has the pick of the top accounts.

- Nationwide has just upped its bank switch bonus to a massive £200. So, if you want some free cash for moving banks, there's never been a better time to do it. Our best bank accounts guide has all of the info.

- Got credit card debt? With the cost of borrowing rising, now's a good time to shift your debt to 0% (while you still can). See our best balance transfers guide for the latest deals.

Data Trends.

- Business travel: How much should an employer pay per mile? NimbleFins explains the rules. And see our poll results to see how other employers compare to yours.

NimbleFins Newsletter 20 September 2022

Following the sad passing of Queen Elizabeth II, all domestic news has been effectively on hold for the past ten days. Now the period of national mourning has passed, and Her Majesty has been laid to rest, we can gradually expect other topics to return to the headlines.

In just over a week's time, the cost per unit of energy will rise. While things don't look quite as bad as they did a few weeks ago - now that typical energy bills will only be £2,500 per year - keeping warm this winter will still be a financial challenge for many.

Aside from the recent £150bn announcement to cut prices, the Government has confirmed millions of consumers will also receive a £400 payment to help with rising bills. This week we've taken a closer look at how the Energy Bills Support scheme works, and when households can expect to be paid. Also in the energy sphere, rising prices means many of us will be looking for ways to cut our usage. So to help, we've taken a look at whether it's cheaper to wash dishes by hand as opposed to the dishwasher. (Don't say we don't consider the finer details!)

In other news, it was recently revealed that UK inflation has eased slightly. The latest 9.9% CPI figure for August is a tad below July's 10.1% - a 40-year high. Despite the fall, many believe the outlook for the UK economy remains bleak. The pound is now at a 35-year low against the dollar which, as well as high inflation, has put pressure on the Bank of England to raise interest rates AGAIN on Thursday. But will any raise be higher than 25 basis points? We can only wait and see.

Elsewhere this week, we've taken a look at UK house prices to understand if a slowdown is on the horizon. We've also done some analysis on whether driving with a cat or dog can impact your car insurance premium. Plus, we've a host of hot money-saving deals too, including £10 cashback at Argos, 2for1 at Alton Towers, and cheap ice cream!

Enjoying our newsletter? Forward this email to friends & family so they can keep on top of our latest money news, deals and tips. Plus, we're giving away a £50 cash/Amazon voucher to one lucky person (UK only) who signs up for our newsletter between now and 11.59pm on Mon 3 October AND one of our existing newsletter readers! Winners will be notified on 4 October by email.

Fun Deals.

- Argos shopper? Make a purchase through Topcashback and get £10 cashback on a £10+ spend*.

- Cheap 'Beats Flex' for students. Subscribe to Apple Music & claim 'free' earphones after 30 days. Cancel after 1mth or it's £5.99/mth.

- Grab a hot choccy for 99p. Part of Tim Horton's 'Deal of the week'. Ends Sunday.

- NHS or emergency services worker? Get a 2yr Blue Light card for £4.99 and bag BIG discounts (too many to list)!

- Feeling peckish? Grab a £5 discount on a £10 spend at Just Eat* through Topcashback

- Three customer? Pay just £1 for any barista made drink at Caffè Nero. Must download Three+ app.

- Superdrug savings. Until end of Sep, get 100% cashback (up to £10) at Superdrug* via Topcashback

- 2for1 at LEGOLAND Windsor, Alton Towers, SEA LIFE Aquariums & more via Kellogg's promo packs. See full T&Cs.

- Cheap Ice Cream. 1ltr Mackie's 'Luxury' Dairy Ice Cream £2 at Tesco. Must have Clubcard (usually £3). Eat responsibly!

Important Money News (what is happening NOW).

- Energy bills: When will I receive the £400 energy grant?

- House prices have risen again for the 13th month in a row, but experts are warning of a slowdown of the property market as growth eases. Here's what we know.

- The savings market continues to look healthy, as bank's scramble for saver's cash amid higher borrowing costs. Since our previous newsletter, rates have improved on both easy-access and fixed accounts. See our best savings guide for the latest NimbleFins top picks.

- With the Bank of England tipped to raise interest rates on Thursday, we could soon see a slowdown on the number of 0% credit cards available. This could be particularly bad news for those with existing credit card debt, as it's possible generous 0% balance transfer credit card deals will begin to worsen.

Money Tips.

- Are you struggling to cope with the rising cost of living? For ways on how to cook on a budget, to tips on reducing your energy usage, take a look at the NimbleFins budgeting section for inspiration on how to slash everyday costs.

- 51% of consumers could save £319.03 on their car insurance. Learn more and get quotes today*.

- Ever wonder if driving with your dog or cat could affect your car insurance? Because it can. We explain how to stay safe and legal.

Best Financial Products.

- Got savings? If you're earning a poor interest rate on your cash, it's probably worth finding a new home for your cash. Right now you can earn 1.85% easy-access, or up to 3.8% in a fixed account. Our updated best savings accounts guide has all of the details.

- Fed up of your current bank? Hungry for free switching cash? Looking for ongoing perks? Whatever the reasons for giving your current bank the boot, it's likely you can find a better account. Our best bank accounts guide has the full lowdown, including THREE hot £175 bank switch offers.

- Carrying a credit card balance can be difficult to manage at the best of times. Yet if you're paying interest on credit card debt, you could be carrying an additional, unnecessary burden. That's because a balance transfer credit card allows you to shift existing debts to it, but at 0%, which can give a huge respite from paying interest. There's still a host of deals out there, including 34 months at 0% (2.88% fee), or for up to 22 months (no fee). Full details in our best balance transfers guide.

Data Trends.

- In response to a reader question, we've looked into whether it's cheaper to wash dishes by hand or use a dishwasher. Here's what we found!

- Would solar panels work well on your home? NimbleFins looks at why solar is cost effective in one home, but not another.

NimbleFins Newsletter 06 September 2022

Liz Truss is unlikely to enjoy any sort of honeymoon period (and quite rightly too)! Many are already on the brink as a result of soaring inflation. And with the news that average energy bills will increase by 80% for millions of households from October, the idea of the new PM ignoring the current energy crisis is simply unimaginable.

Speculation is already mounting that energy prices will have to be capped at their current level, with suppliers set to be supported by taxpayer-backed loans. Yet even if the Government does come up with a temporary solution, UK households will probably have to get used to paying far more to heat their homes in the years to come.

To dodge high energy bills in the long-term, you may have thought about renewable energy solutions. We have too which is why, this week, we've explored how long it takes to pay back solar panels. On the topic of cutting bills, we've also done some analysis on whether it’s cheaper to boil water with a kettle or by using the stove (the result may surprise you)!

Elsewhere in the personal finance sphere, a new mortgage lender has been given a licence to offer 50-year mortgages. But are ultra-long home loans a good idea? Also this week, we've taken a look at Barclaycard's £20 cashback offer on its interest-free purchase credit card. Plus, we've the lowdown on what happens to your credit score when you apply for a credit card, plus a tip on how you can avoid multiple searches on your credit file. As always, we've host of deals this week too, including £5 off your next Amazon purchase, and £10 cashback on a £10+ spend at Tu.

Enjoying our newsletter? Please forward this email to friends & family so they can keep on top of our latest money news, deals and tips. We're still growing, so sharing this newsletter really helps!

Also, if you have Twitter, why not follow us?

Fun Deals.

- Can you get £5 off your next £15 Amazon purchase? Check this link to discover if you're eligible. Select accounts only. Discount only on items sold by Amazon. Ends 11 Sep.

- Plan for summer 2023. Sunlounger discounted to just £15 at Homebase (usual price £35).

- Grab a FREE 7ml perfume sample. Must sign up to Lancome's newsletter. 50,000 available.

- Save some dough. Grab any size pizza for £6.99 with Pizza Hut's Mega Week. Is your local store participating?

- Back to school. Term may have started, but there's still time to get £10 cashback on a £10+ spend at Tu*, via Topcashback.

- Interested in a free Google Cloud course? Use code: GCP-LABS at checkout (hundreds to choose from).

- Caffeine hit. Grab a small French Vanilla coffee for 99p via Tim Horton's 'deal of the week'

- New to Spotify? The streaming service is offering 3 months premium for free. Sign-up & cancel to avoid paying £9.99/mth when trial ends.

- Get £5 off a £45 shop at Iceland online. New custs only. Use code: HIFIVE at checkout. (£40+ spends get free delivery too).

Important Money News (what is happening NOW).

- Supermarket Iceland and Utilita Energy are offering free workshops to families to offer ways to cut bills with savvy cooking tips.

- A new lender hoping to offer 50-year fixed rate mortgages has been given a UK banking licence. But is a 50-year mortgage a good idea? NimbleFins looks at the pros and cons.

- Right now there's a credit card that allows you borrow at 0% for up to 25 months that also pays £20 cashback on top. The deal ends on Friday, but is it a good card to go for? We take a look at the 0% purchase credit card market.

- Did you know that cash withdrawals are up 20% compared to a year ago? NimbleFins takes a look at whether using notes over plastic can help you budget amid the cost of living crisis.

Money Tips.

- Are you thinking about getting a credit card but concerned about the impact on your credit score? Fear not. Applying for credit isn't a big deal for most. Click here to find out why.

- Is it cheaper to boil water for tea with a gas hob or electric kettle? We ran a test to find out. Click here to see the results, they might surprise you.

- With car insurance rates on the rise and the general state of household finances, it's more critical than ever to compare quotes and buy early. If you buy at the last minute, you might pay 30% extra. See which companies are cheapest and rank the best, and get quotes in minutes.

Best Financial Products.

- Savings rates have risen a lot over the past few months. Right now you can get 1.81% easy-access, or up to 3.51% in a fixed account. Can you save each month? A regular savings account might be for you. Rates are up on these accounts too, with the top open-to-all deal paying a cool 3% (fixed for 1yr). Full info in our best savings accounts guide.

- Fancy a free £175 for switching bank account? Take a look at all of the current bank switch offers in our updated best bank accounts guide Even if you don't want switching cash, there's an account out there to suit everyone. (Don't stay with your current bank out of loyalty!)

- If you're paying interest on credit card debt, getting a new balance transfer credit card is probably a wise move. These specialist types of credit card allow you to shift existing debts to them, at 0%. Right now you can move debt for up to 34 mths (2.88% fee), or for up to 21 mths with NO FEE. Our best balance transfers guide has all of the details.

Data Trends.

- With electricity prices skyrocketing and the UK coming off a hot and sunny summer, you may be wondering if you should invest in solar panels for your home. But what are the economics of it? NimbleFins looks in depth at the time it takes to pay back the typical £6,000 solar panel investment.

NimbleFins Newsletter 23 August 2022

The new energy price cap will be revealed on Friday. It's expected Ofgem will hike the existing cap by more than £1,500, with bills for a household with typical usage set to hit £3,576 per year. Yet, there are fears the price cap will go even higher next year, with some expecting it to breach £6,000 by April 2023.

Whatever the exact figure of the cap, we know that the cost of energy is set to rise massively in October. With this in mind, we've a bunch of energy tips in this week's email. We've taken a look at how long it would take to replace the cost of installing solar panels. We've also taken a look at whether it's worth fixing your energy bill right now, and have highlighted all of the risks you need to be aware of. Plus, we explore a possible plan by four big energy providers that could potentially freeze bills.

Sticking with the theme of rising prices, the Office for National Statistics has revealed UK inflation officially hit double digits in July. This is unlikely to be the peak of rising prices, with some groups fearing UK inflation will reach 18% next year.

Unfortunately we don't have all of the answers to rising bills. However, we can tell you that sorting your finances is one of the best ways to relive the pressure on your wallet. Right now, you can bag up to 3.55% interest on your savings, grab a £175 bonus for switching bank account, and shift debt for up to 34 months interest-free. We've updated all of our product guides to give you the ins and outs of these market-leading deals.

Finally, we've also taken a look at the private health insurance market this week, including the costs of a typical policy. We've a number of hot deals too, including a FREE Puregym pass, cheap ice cream, and a ridiculously low SIM deal that won't cost you more than 1p per month for six months.

Enjoying our newsletter? Please forward this email to friends & family so they can keep on top of our latest money news, deals and tips. We're still growing, so sharing this newsletter really helps!

Also, if you have Twitter, why not follow us?

(And congratulations to Rebecca, our £50 draw winner after a Google random number generator determined our winner!)

Fun Deals.

- Cheap ice cream! Make the most of summer with £2 off Wall's Cornetto Soft Cookie & Chocolate at ASDA. Must download voucher.

- Grab a 1yr Disney+ subscription for under £20 (usual cost £79.90/yr). Must buy code through Gamivo and redeem on Disney + website by 14 Oct. See Gamivo website for full Ts&Cs.

- Another week, another ridiculously cheap SIM deal. Pay 1p for 6mths (£6.90 after) for 12gb data, unlmtd texts & mins, plus EU Roaming via Lebara mobile. New custs only. Must use this link.

- Posting a parcel? Royal Mail is now collecting parcels from your door FREE until the end of the year.

- Save 33% on a railcard. If you're eligible, grab a 1yr digital railcard for £20 (usual price £30), or a 3yr railcard for £47 (usual price £70) via Trainline. Must use code: SUMMER33 at checkout.

- Discounted strawberries for £3. Tesco has reduced its 1KG pack of strawberries to just £3. Available in-store.

- Save on groceries with Iceland's new 'essentials' range. Warburtons sliced bread for 69p, 6pk crumpets for 85p & more.

- Love Disney? Get a further 10% off already discounted items at its Outlet store. Use code: OUTLET10 at checkout.

- Feeling the fitness vibe? Grab a FREE 3-day pass at Puregym. Use code: FREEPASS. See Puregym website for full Ts&Cs.

Important Money News (what is happening NOW).

- How long does it take to repay cost of solar panels? New analysis shows it's just four years.

- Hope for households as four big energy providers back plan that could freeze energy bills.

- Can you protect yourself from soaring energy bills by getting yourself on a fixed tariff? And what are the risks of getting a fixed deal?

- Fancy a free £175 for switching banks? Santander has matched First Direct by upping its bank switching incentive. See our best bank accounts guide for all of the details, plus more switching offers.

Money Tips.

- Are you able to save money every month? A regular savings account could be for you. These are specialist types of savings accounts that often come with juicy interest rates. Right now, there's one account paying up to 5% AER, but are you eligible for it?

- Ever think about buying heath insurance but not sure where to begin? Read our private health insurance buying guide that explains what to look for, where to buy, what to avoid, and more.

Best Financial Products.

- Even though inflation is rampant, it's still worth getting the highest interest rate you possibility can on your savings. Right now you can earn 1.85% easy-access, or up to 3.55% fixed. If you're able to save regularly, you could boost your interest rate further. Our best savings accounts guide has the full lowdown.

- There's tonnes of reasons you may wish to switch bank account. From bagging free cash or switching, ongoing perks, cashback, or access to a 0% overdraft. Take a look at our best bank accounts guide for everything you need to know about moving account.

- Are you paying interest on credit card debt? A balance transfer card could slash your interest rate to zero for a set period. Despite the Bank of England increasing the cost of borrowing, generous 0% balance transfer deals are still abundant (for now). Right now, you can shift debt for up to 34mths at 0% (2.88% fee), or for up to 22mths with NO FEE. Our best balance transfers guide has all of the details.

Data Trends.

Wondering how much it would cost to buy private health insurance? NimbleFins runs the numbers for the cost of health insurance for different ages and locations around the UK.

We put an * next to any products for which we can receive a commission.

NimbleFins Newsletter 09 August 2022

Enjoying our newsletter? Forward this email to friends & family so they can keep on top of our latest money news, deals and tips. Plus, we're giving away a £50 cash/Amazon voucher to one lucky person who signs up for our newsletter between now and 11.59pm on Mon 22 Aug.

Also if you have Twitter, why not follow us?

Last week, the Bank of England raised its base rate by 50 basis points in a bid to tackle soaring inflation. It now stands at 1.75%.

If you're a mortgage holder on your lender's standard variable rate (SVR) it's likely your monthly mortgage payment will go up as a result of the rise. If you're a fixed deal, the impact of a higher interest rates will be felt when it's time to remortgage. So, while the impact for mortgage holders is straightforward, what about house prices? This week, we've crunched the numbers and have explored whether house prices are set to rise or fall.

Are you a saver? If so, you may see higher interest rates in a positive light. That's because savings rates typically rise when borrowing costs increase. While it usually takes a while for rate rises to filter through to the savings market, we're already seeing savings rates creep up as a result of last week's increase. Right now, the top easy-access account pays 1.81%. Our updated savings guide has all of the details.

On more of a negative note, there are fears annual energy costs will exceed £4,000 from October. While we can't do much about the financial pain, it's worth knowing that energy prices can differ depending on where you live. To help you get a clearer picture of your future energy costs, we've taken a closer look at the price per kWh of electricity in each area of the UK. Are you facing higher energy costs than the average UK home?

Meanwhile, we've the lowdown on the pros and cons of the Hargreaves Lansdown investing platform. Plus, we've a brand-new guide to help overseas students sort their finances when arriving in the UK. For the deal hunters our there, we've a bunch of moneysaving offers this week, including a bargain 99p monthly SIM deal with 12GB of data, and £10 off TU clothing.

NimbleFins Energy Newsletter Special

The Cornwall Institute predicts average household energy bills could reach £4,266 next year. Ofgem’s decision to increase the price cap review to every 3 months, up from every 6 months, has been cited as one of the main reasons for this latest price increase.

This latest estimate means households will be paying an average of £355 per month for their energy bills instead of the current £164 average a month. This would mean the typical household will pay £2,989 more on their energy bills in January 2023, compared with the average cost of energy in December 2021 which stood at £1,277.

Related NimbleFins articles:

- Why Are Energy Prices So High Right Now?

- Will Brits need to take shorter showers, turn off lights and lower the thermostat to avoid blackouts this winter?

- 11 Ways To Save Energy In The Home

- Energy Switching Guide to Energy Tariffs

- Best And Worst Energy Suppliers 2022

- Energy Firms Work Together To Help Britons

- Surge In Renting To Lodgers As Energy Bills Rise

Fun Deals.

- Ultra-cheap 30-day rolling SIM: Pay 99p for 6mths (£6.90 after) for 12gb data, unlimited texts & mins, plus EU Roaming via Lebara mobile. New custs only. Must use this link.

- O2 customer? You can now get free airport lounge access if your flight is delayed. See O2 Priority website for full Ts&cs.

- New home or kitchen? Check out this half price Kitchen Starter Set at Argos with free click & collect.

- Grab a free kids meal at Frankie & Benny's. Offer is daily between 11am-12noon as part of the #NoChildGoesHungry campaign.

- Iceland shopper? Grab £10 cashback on a £35+ spend at Iceland via Topcashback*.

- North Face sale. Get up to 50% off jackets (plus free delivery on a £50+ spend).

- Fast food lover? Get free rewards for signing up to McDonalds Rewards app (sometimes with no min spend required). Eat responsibly.

- Rescue good food before it's thrown out. Sign up to the 'Too Good to Go' app for food discounts at local shops & restaurants.

- Buying clothes before the back to school rush? Get £10 cashback when spending £10+ at TU clothing via Topcashback*.

Important Money News (what is happening NOW).

- Are house prices going up or down? Read our recap of recent conflicting reports on the UK housing market.

- Is the British reality this winter going to involve taking shorter showers, turning off lights and lowering the thermostat to avoid blackouts? NimbleFins looks into what might really happen.

- Almost half a million international students studied in the UK in 2021/22. So, with a new academic year just around the corner, we've created a brand new guide explaining how international students can get their British finances in order - from setting up a bank account, to tips on transferring money overseas.

- Saving rates have already risen following last week's base rate rise. But is now a good time to move your money? And are savings rates likely to continue rising in future?

Money Tips.

- Looking to invest? Whether you want an ISA, SIPP or normal investing account, we take a look at the pros and cons of using the Hargreaves Lansdown platform.

- Need to borrow a friend's car or share driving on a road trip? NimbleFins looks at short-term car insurance so you can find a policy that suits your needs and budget.

- Curious which UK car insurance companies are most popular? Read our analysis highlighting the UK car insurance providers with the most customers.

Best Financial Products.

- Now that borrowing costs have risen, you'd expect savings rates to have climbed too - and, thankfully, they have. Right now you can grab 1.81% easy-access, or up to 3.45% fixed for five years. Take a look at our savings guide for a list of the market-leading accounts, plus other savings tips.

- Whether you're fed up of your bank, want free switching cash, or eager for an account with perks, take a look at our best bank accounts guide for the full lowdown. (Now's a really good time to give your old bank the boot as you can currently get up to £160 for switching).

- If you're paying interest on existing credit card debt a balance transfer credit card can massively help cut what you owe. Right now you can shift debt for up to 34 months interest-free (2.88% fee), or 22 months with no fee. See our best balance transfer guide for full info, plus more deals.

Data Trends.

What will the energy price cap increase in October mean for prices in your area? We've calculated potential electricity costs per kWh in each region of the UK. See what you might be paying this winter.

We put an * next to any products for which we can receive a commission.

NimbleFins Newsletter 26 July 2022

Now the weather has (thankfully) cooled, the cost of living crisis is very much back in the headlines. This week, we take a look at the food items that have risen the most over the past year, and discover how consumers are altering their buying behaviours. Strikingly, only 3% of respondents to our poll said they hadn't made ANY changes to their food spending habits to combat soaring prices. Are you one of them?

In other news, almost a quarter of a million people have been underpaid their state pension entitlements, with the Department for Work & Pensions facing a £1.5 billion bill for the shortfall. We take a closer look at the story, and explore which group is most likely to have been underpaid.

Meanwhile, in the personal finance sphere, we've noticed that savings rates are still on the rise - particularly rates on notice savings accounts. Plus, a new regular savings account has launched offering a whopping 5% variable interest, though sadly not everyone can open it. Full details can be found in our best savings accounts guide.

Aside from our personal finance expertise, we've also answered the question you've always wanted to know the answer to: why are coffee tables so expensive? Plus, we've a number of hot money-saving deals, including how you can bag 2for1 tickets at Alton Towers, and get £5 off your next Just Eat takeaway.

Enjoying our newsletter? Please forward this email to friends & family so they can keep on top of our latest money news, deals and tips. We're still growing, so sharing this newsletter really helps!

Also, if you have Twitter, why not follow us?

Fun Deals.

- Homeowner? Have your boiler serviced by British Gas for just £49 (usually £90). Existing British Gas customer? Pay just £29.

- Free Superdrug goodies. If you're a TopCashback member you can spend up to £10 at Superdrug & get 100% cashback*. So spend under a tenner and your purchase will essentially be free.

- Can you cut the cost of a takeaway? Grab £5 off a £10+ spend at Just Eat* when ordering through Topcashback.

- Cheapest 30-day rolling SIM is now even cheaper: Pay just £1.40 for 6mths (£6.90 after) for 12gb data, plus unlimited texts & mins via Lebara mobile. New custs only. Must use this link.

- Next shopper? It currently has a 50% clearance section on its website with free click&collect.

- Kids eat for £1 at Farmhouse Inn! Join their 'email club' and you'll get a voucher for a £1 kids meal with a full paying adult (excludes Sundays). Offer available until 20 Aug in Scot, 3 Sep in Eng & Wal.

- Krispy Kreme fan? If you sign up to its app you may be offered deals & discounts, incl 20% off personalised donuts, & 10% off shakes & ice creams.

- Can you find a bargain? Find rare Amazon discounts through their little-known 'Warehouse' website - home to returned items at knock-down prices.

- Cut the cost of a day out. Bag 2for1 adult tickets to Alton Towers, Sea Life & other Merlin attractions via promotional Kelloggs cereal packs. See full details.

Important Money News (what is happening NOW).

- New calculations estimate 237,000 people have been underpaid their state pension entitlements with the Department for Work and Pensions (DWP) now owing £1.5 billion. Here's what you need to know.

- Cancer sufferers quoted up to £7k for travel insurance are being denied much needed holidays, with the industry accused of "sticking the boot in" to the sick. Here's how cancer charity Planets is campaigning to stop the travel insurance ‘scandal’.

- Right now, there are FOUR banks that'll reward you for ditching your account. Here's how to get paid up to £150 for switching bank.

Money Tips.

- Paying interest on credit card debt? Here's how one specialist type of credit card can massively help you cut what you owe, potentially saving you £1,000s in interest.

- Want to buy a coffee table buy finding they're too expensive? You're not alone. One of our researchers was in the same boat recently (as an aside, boats have gone up in price, too, but that's for another day) so he wrote an analysis of why coffee tables are so expensive and he looked at 7 of the largest retailers to compare costs. Read this before you buy!

Best Financial Products.

- Savings rates are continuing to head upwards. Right now you can earn 1.56% easy-access, or up to 3.31% fixed. Plus, there's a new regular savings account that pays a massive 5% AER variable interest, but do you qualify for it? Our best savings account guide has all of the details.

- Ready for a new bank account? Whether you fancy a £150 switch bonus, an account with perks, or a 0% overdraft, take a look at our best bank accounts guide for an updated list of the top accounts.

- Despite rising interest rates, lengthy 0% balance transfer credit cards are still available (for now). Shift credit card debt for up to 34 mths 0% (2.88% fee), or for up to 22 mths with no fee. See our best balance transfer guide for more information, plus other options.

Data Trends.

Food prices rose 9.9% in the 12 months from June 2021 to June 2022, see which food prices are up the most (some prices are up over 14%, including milk, cheese and eggs!).

How are consumers reacting to rising food prices? Our recent poll shows where and how people are cutting back to save money. Click here to take the poll yourself. Here are the latest results:

Poll 1: What people are buying less of now

Poll 2: How shopping habits are changing

We put an * next to any products for which we can receive a commission.

NimbleFins Newsletter 12 July 2022

With resignations left, right and centre, the UK political landscape dominated the news last week. Whatever your thoughts on the current situation, the UK is now facing a severe cost of living crisis at a time when the Government is lacking authority.

If you're struggling with rising bills, the latest revelation that the energy price cap is expected to rise by 65% in October will be difficult to digest. While we don't have all the answers, this week we've taken a close look at why energy prices are so high, as well as the chances of prices falling in future. We've also explored whether it's worth fixing your energy, as well as highlighting what support the Government is offering to help with rising bills.

On a more positive note, savings rates are continuing to rise, as the cost of borrowing creeps up. Right now, it's possible to get up to 3.45% interest. So if you've savings, now's a great time to find a home for your cash (our best savings guide has all of the details)!

Meanwhile, we’ve also taken a look at why so many Brits think it's OK to mislead insurers, and have also explored why there are fewer electronic vehicles on the road than you might think. Our latest data shows that the cost of one essential is dropping - car insurance - so take advantage while you can. Plus, we’ve the lowdown on the latest bank switch offers, including a hot £170 offer from HSBC - though you'll have to go quick if you want it as the deal ends soon!

Fun Deals.

- Got an Amex card? Some cardholders can get up to £20 back for £100 spend through PayPal. Check your 'Amex offers' page to see if you're eligible.

- 'Less than half price' Amazon Fire TV sticks ahead of Prime Day, incl 4K Fire TV Stick for £22.99 (usual price £49.99).

- Struggling with high petrol and diesel costs? This nifty tool allows you to compare prices from local forecourts.

- 50% off Amazon Kindle eBook devices as part of Prime Day. Grab a Kindle for £34.99.

- Collect Nectar points? Check your eBay account to see if you're eligible for 300 bonus Nectar points. Must activate offer before 21 July and sell 1 item by 4 August.

- Keen cinemagoer? Get 30% off Odeon myLIMITLESS membership via Groupon deal. Pay £135 instead of £193 (incl London West End).

- Pay a visit to Warwick Castle for just £22, via Planet Offers (usual price £37).

- Dirt cheap 30-day rolling SIM: Pay just £1.99 for 6mths (£6.90 after) for 12gb data, plus unlimited texts and mins via Lebara mobile. New custs only.

- Try Paramount+ streaming service free for 1mth using code 'SHORE' at checkout. Cancel before trial ends, or it's £6.99 per month

Important Money News (what is happening NOW).

- Millions of workers given National Insurance tax cut - how is your salary affected?

- Energy firms work together for plan to help Britons as bills forecast to rise to £3,300. Will it work?

- Why are energy prices so high right now? And what support is available to help with bills? We take a look at the current UK energy market and explore whether there's a chance prices will come down soon.

- We also dig into Martin Lewis's recommendation for some people to switch to a fixed energy tariff now. It's not for everyone, but could it work for you? NimbleFins runs the numbers.

Money Tips.

- Nearly half of UK consumers think it’s OK to mislead insurers (but it really isn’t). Read more here.

- Heading away? With peak travel season upon us, it's vital you take the right plastic with you on holiday. Otherwise, you could be hit with an array of fees and charges. In this article, we explore the top three debit cards to use overseas.

- Data shows that car insurance is cheaper than it's been in years. If you're up for renewal, be sure to take advantage and compare car insurance quotes* in the market before you automatically accept your renewal, especially if your premium has risen.

Best Financial Products.

- Got savings? Interest rates are rising, so now's a great time to find a home for your cash. Get 1.56% easy-access, or up to 3.45% if you're happy to lock away cash.

- Fed up with your bank, or hungry for some free switching cash? There are a host of bank account offers out there right now, including a juicy £170 from HSBC, plus a brand new £150 bonus from Halifax.

- Paying interest on credit card debt? A balance transfer can cut your interest rate to zero, which can help you become debt-free quicker. Right now, you can move existing debt to 0% for up to 34 months (2.88% fee), or for up to 22 months with NO fee. Our best balance transfers guide has all of the details.

Data Trends.

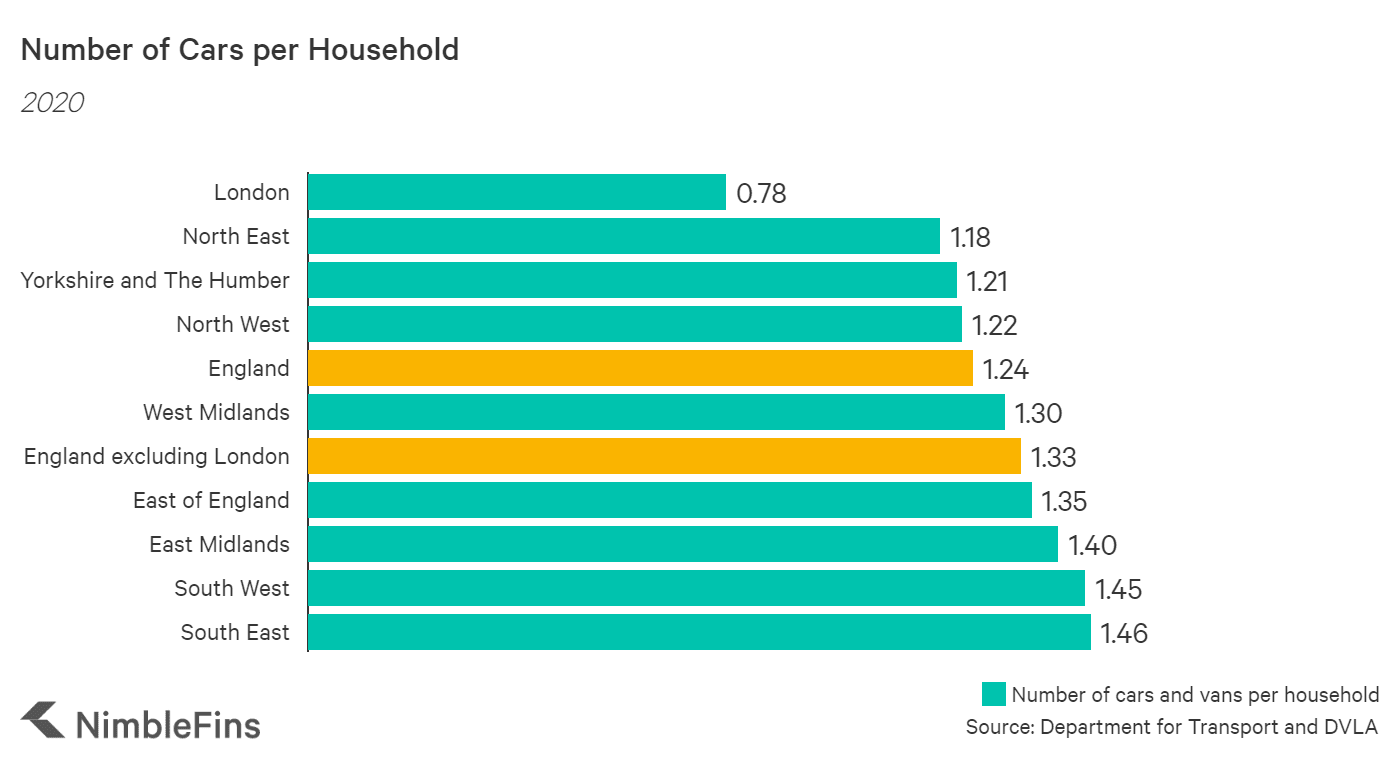

British households own more cars than ever. See how your region compares.

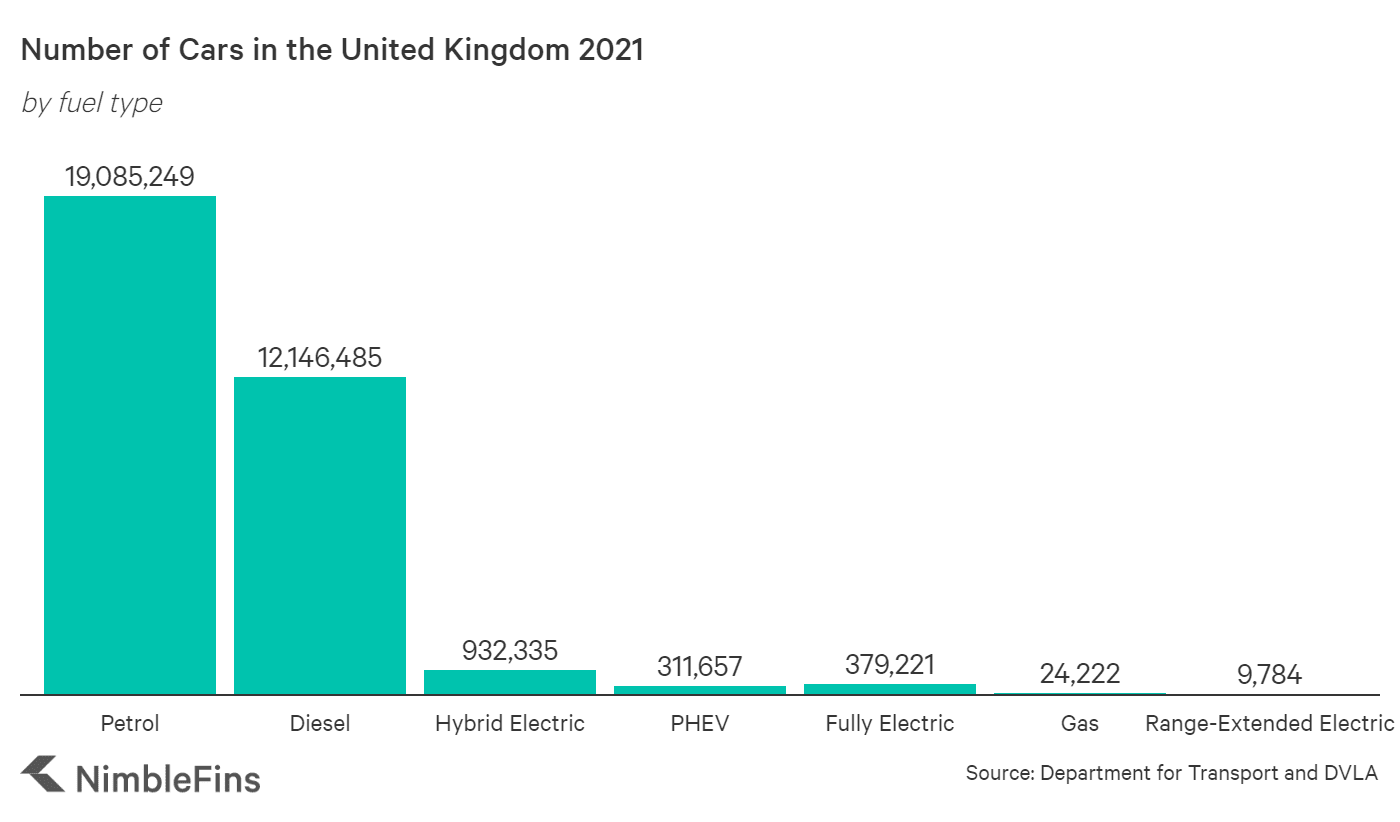

Does it feel like EVs are all the rage and everywhere now? They still only represent 5% of on-the-road cars, but that's changing rapidly. Read more here.

Have you been sent this email by someone else? Subscribe to the NimbleFins Newsletter above!

You can also unsubscribe at any time.

We'll put an * next to any products for which we can receive a commission.