10 Tips to Save Money for a Debt-Free Christmas

The Bank of England found that the average household spends an additional £500 more in December alone, due to the impending festivities. A survey by Halifax also found that the UK spends over £20 billion on Christmas, an average of close to £800 per household (£542 per adult) to cover the cost of presents, food, trimmings, etc.

With those figures in mind, it may come as no surprise that almost 1 in 5 people become in debt due to the amount they spend at Christmas as they struggle to meet January repayments, according to The Independent. In fact, we found the average household has over £7,800 in consumer debt to pay off—and big spending at Christmas doesn't help this. From presents to trimmings, lavish dinners and everything in between, it can leave you feeling less merry and more cash-strapped by the end of it.

If this sounds familiar and you are looking at how to have a great Christmas without the great expense or financial stress, here are 10 tips to save money for a debt-free Christmas:

Create a plan and set a spending limit

Starting as early as possible, write down everyone who you plan on buying presents for and the type of gift you have in mind. Whilst Christmas shopping for each person is all part of the fun, having a few ideas jotted down for each person can help prevent panic buying as the big day approaches.

It's not uncommon to see people scrambling in the days just before Christmas realising they have forgotten someone and have to buy whatever they find, often spending more money because they don't have time to look for deals or just because they feel guilty they forgot! This is spending you may really regret when you look at your January statement.

It also helps to set an overall spending limit by realistically working out what you can afford to spend whilst covering your rent/mortgage and other household outgoings. If you are doing any Christmas shopping on a credit card, only spend what you can afford to immediately pay off in full.

Remember that any spend on Christmas is not essential in comparison to keeping a roof over your head, feeding your family and avoiding debt. And finding yourself under Christmas debt is a terrible way to start a new year. It might help to keep in mind a cost limit per person, as it's easy to go overboard if you get carried away in the shops or if a seemingly 'great deal' pops up online.

Earn extra money for Christmas

From getting a part-time retail job or babysitting to selling your stuff or even selling your story, there are many creative ways to earn extra money to set aside for Christmas expenses. Depending on your skill set and what you have stored away in your cupboards, there are many ways to drum up enough money to pay for Christmas without having to go into debt.

Open a savings account

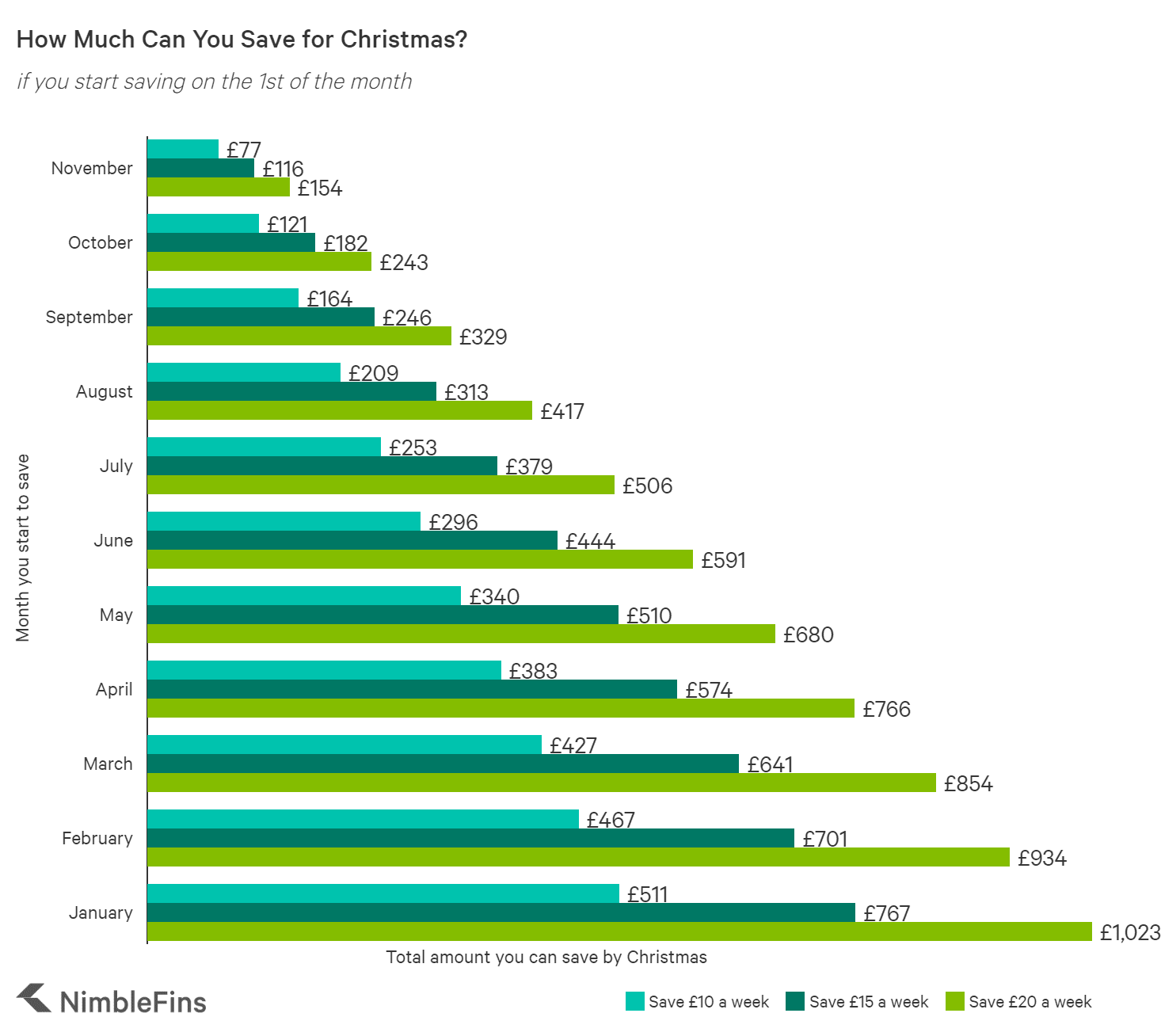

If you plan on saving a little each month to cover the cost of Christmas, one of the best ways to ensure you don't accidentally spend it on takeaways or get tempted to, is to open a dedicated savings account. Even a small amount saved per month can add up to a lot towards the end of the year. For example you can even get the kids involved too, which will help teach them about money and financial responsibility at the same time.

By only using that account to buy presents and other Christmas items, it's much easier to stay within your Christmas budget knowing all your regular bills will still be covered. It can really take the stress out of the situation because you know exactly what you have to spend.

Do not turn to payday loans

The adverts for payday loans are everywhere these days and in times of financial stress, it can seem very tempting to get one—especially when thousands can be put into your account in just a matter of minutes. The stark reality is that payday loans are very expensive—the interest rates can be up to 1,500% compared with the typical credit card APR of around 22%. As a result it's very easy to get into horrendous debt trying to pay back a payday loan.

If you are considering a payday loan to pay for Christmas because of poor finances, the sad truth is that you will likely be left much worse off afterwards. Many people have been crippled with debt due to payday loans, so they should be avoided at all costs.

If you're still not convinced, consider that borrowing £1,000 for Christmas expenses on a payday loan could cost you £1,720 to pay back within just 3 months (according the the QuickQuid calculator). That's £720 in interest payments, over just a few months! In other words, if you don't take out the payday loan you'd be £720 richer at the end of the day. While credit cards are typically a cheaper option, you really shouldn't carry debt on a credit-builder card, in particular.

Shorten your Christmas list

It sounds harsh but Christmas can really get out of hand. From sending cards to your Aunt's neighbours vet, to buying presents for every single person you share DNA with. Before you know it, your living room could double as an Amazon warehouse—it's just too much.

As a family, it's worth discussing the idea of shortening your Christmas list, to perhaps include just the children or reduce the number of presents each person gets or starting new traditions in your family. For example use a "Secret Santa" system where each person pulls one name out of a hat and buys just one gift for that one person. Gifts can be limited to an amount your family feels appropriate. In some cases an extremely low limit can be more entertaining as it requires great creativity! If you worry that it might be uncomfortable to talk about Christmas finances, you'd be surprised how many family and friends probably feel the same way.

Money saving expert Martin Lewis even went as far as to create a “PRE-NUPP”—a pre no-unnecessary-present-pact. Thousands responded in their droves when he appeared on TV discussing the issue with his viewers. The main message he wanted to share is that you can still have an absolutely fantastic Christmas without getting yourself into debt.

Deal hunt early in the year

Throughout the year retailers are always having huge sales, especially on toys for the kids. There's even Black Friday in November which if you plan correctly and avoid buying things you didn't intend to, you'll find there's plenty of savings to be had.

The more you can spread the cost throughout the year, the less financial pressure this will create in January. It will also mean less stress as you approach Christmas, because you know you've already bought presents well in advance and made savings compared to if you had tried to buy everything at once when it's not on offer.

Be sure to use comparison sites such as the 'Google Shopping' function to double-check you are getting the lowest possible deal, even if your item is already on sale.

Keep an eye on other expenditure

With the spending madness that ensues during the festive period, it's easy to forget about your other everyday expenses that also need to be paid at the same time.

It's a good idea to regularly comb through your bank statement. Check for any unnecessary outgoings such as unused gym memberships that could be cancelled or reduced. You'll also need to get an idea of just how much money needs to come out before you factor in your Christmas spending.

It's great to catch up with lots of friends and family during the run-up to Christmas, but make sure it's not leaving you out of pocket. If you'd normally head out for an expensive meal, why not invite everyone over instead? You can still have a great catch up at a fraction of the cost.

Practice restraint

As Christmas approaches, it's all too easy to get swept up buying too much food or going overboard with the decorations. You might even have finished your Christmas shopping but then see something else you feel compelled to buy for someone. It's this type of financial behaviour which can soon start to add up to a very large amount without you even realising.

Be realistic, just how much food and drink does you family need over Christmas? If you are usually eating Turkey sandwiches for weeks afterwards, and there's 6 rolls of wrapping paper left for next year, and 9 boxes of Jacob's crackers nobody managed to finish - then it's a sign you're buying too much.

By only buying what you actually need and not getting caught up in the frantic Christmas rush it will save a lot of stress, not to mention money.

Trade in reward points

There are various retailers who offer points everytime you shop with them. One of the best on the high street is Boots, who also give members additional coupons and discounts for signing up. There are various triple points events throughout the year, meaning even more rewards on every purchase you make.

Although you might think of Boots as a health and beauty retailer, towards Christmas they really start to expand their stock range, most of which is also on 3 for 2. If you have quite a lot of people to buy for, this really works out as excellent value.

The great news is that even if you don't trade in your points, everything you spend will count towards points for next Christmas too! So, just by using your points card to buy things such as shampoo and toothpaste throughout the year can lead to spending a fraction of what you would on Christmas presents because you can pay in points.

Avoid January sales

We've all seen the news footage of people queuing up outside department stores as early as midnight on Boxing Day, ready to burst through the doors in gargantuan fashion, desperate to pick up a discounted toaster or half-price jumper. Who can resist a deal, right?

It might sound counterintuitive to avoid the January sales, but unless it's something you need it's simply adding more cost and in many cases debt onto your plate. Whilst there's an argument for buying for next Christmas, there's a good chance you won't want to give a year-old present or will even forget you have it in the cupboard.

Whilst picking up that discounted bread maker might feel good in the moment, it sure won't when your bank statement arrives. In reality, all you are doing is helping the stores clear their stockrooms.